What Is Small Cap?

Small Cap Stocks refer to stocks with a small market cap or capitalization, between $300 million and $2 billion. In the short to medium term, Small Cap investing involves more risk and tends to be more volatile than other equity-focused funds, but they offer larger long-term returns. Small caps have the potential to double or triple in value. However, there are risks involved.

Among the advantages of investing in Small Cap companies is the growth potential. All Large Cap stocks started as small businesses. Small Cap stocks empower investors by being part of that exponential growth.

Another one is that large mutual funds don't invest in individual Small Cap stocks. The Securities and Exchange Commission (SEC) has heavy regulations that make it difficult to establish positions of this size.

Lastly, while individual Small Cap stocks involve some risk, small caps usually outperform large caps in the long run. Small Cap investing makes it easier to boost one's returns.

As with any investment, investing in Small Cap stocks involves risks. Without a doubt, it's considered a bigger risk to invest in a small company instead of a blue-chip one. Often, Small Cap companies are chosen based on their potential to grow.

Another disadvantage is that it takes time to determine if a Small Cap company is high-quality. It's not easy to assess if a company has growth potential immediately.

Small Cap stocks involve a high level of risk. Even the slightest market volatility can affect the share prices of small-cap companies. On the other hand, there is also a vast potential for incredible returns. Many investors flock to Small Cap stocks for short-term investment needs, which can be counterproductive. Why? It takes time for small companies to grow.

Lyons Small Cap Value Strategy: Why you should invest

The Lyons Small Cap Value Strategy identifies smaller companies poised for significant growth. By targeting undervalued stocks with solid fundamentals and conservative balance sheets, the strategy aims to maximize returns as business performance accelerates.

At the core of the investment process is fundamental analysis. The experienced investment team screens the universe of small and micro-cap stocks utilizing proprietary models like the GRAPES valuation framework. This rigorous approach isolates quality companies set to profit from economic tailwinds.

While investing in small caps entails greater volatility, the payoff can be exponential returns. By owning stakes early on, investors participate as select leaders rapidly gain market share over the long-term. The strategy's diversification mitigates risks associated with individual names.

Leading the strategy is President and CIO Mark Zavanelli, with over 25 years specializing in quantitative investing. His expertise in identifying data-driven signals and factors that drive outperformance provides a key edge. He heads the investment committee overseeing all strategies.

In Mark's previous roles managing small cap value strategies at firms like Oppenheimer Funds, he consistently topped benchmarks and ranked in the top percentiles. Investors can have confidence in his prudently optimistic approach to pinpointing opportunities.

The Lyons team brings together robust analytics with practical judgment honed from experience. This fusion powers the identification of tomorrows disruptors trading at discounts today.

Lyons Small Cap Value Strategy Past Performance

The Lyons Wealth Small Cap Value Strategy has an established history of outperformance, providing investors exposure to winning small caps. As of December 31, 2023, the portfolio maintains an overall 5-star Morningstar rating, placing it in the top 20% of peers.

Over the last 10 years, the strategy has returned 10.91% annualized compared to just 7.16% for the Russell 2000 benchmark. This excess return demonstrates the success of the investment process in identifying market-beating small caps during all types of economic environments.

The portfolio also displays attractive risk-adjusted returns with a Sharpe ratio of 0.56, well above the index's 0.31. By balancing total volatility, the strategy maximizes compound annual growth.

This alpha generation instills confidence that going forward, the rigorous research approach can pinpoint exceptional smaller companies positioned to beat markets. The selective nature also results in concentration into the very best ideas rather than broadly holding every small stock.

With over 20 years of data, the Lyons Wealth Small Cap Value Strategy has shown it can turn volatility associated with small caps into outsized upside. This consistency sets it apart as an advisor investors can trust to navigate the category.

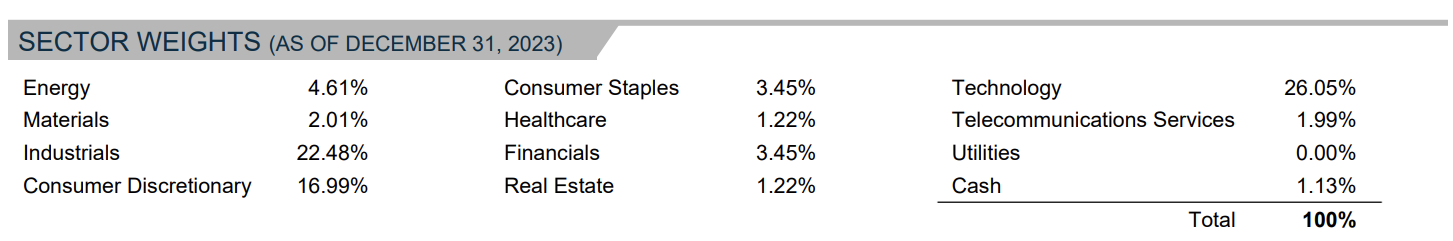

Sector Wise Distribution of the Small Cap Value Strategy

The Lyons Wealth Small Cap Value Strategy maintains a strategic yet adaptive sector allocation to capitalize on economic trends. As of December 31, 2023, the portfolio held the following sector breakdown:

With over a quarter of assets in technology, the portfolio emphasizes fast-growing sectors primed to gain market share. At the same time, diversification into areas like industrials and consumer discretionary allows capturing upside from economic expansion. This balanced exposure allows participation where small caps tend to outperform over market cycles.

The dynamic allocation strategy shifts weighting to wherever business momentum surfaces. Still, prudent risk controls ensure no single narrative or sector drives overall returns. This flexibility but diversification aims to improve consistency of outperformance.

Risk Statistics

While investing in small caps entails embracing some volatility, the Lyons Wealth Small Cap Value Strategy has shown effective risk management over time. As of December 31, 2023, key metrics included:

Standard Deviation (22.67% annualized):

On par with the small cap category, implying strategy does not take excessive risk

Correlation to Benchmark (0.86):

High correlation shows portfolio sensitivity to small cap segment

Sharpe Ratio (0.56):

Risk-adjusted return metric displays attractive balance of risk and reward

Average Up Market Month (4.55%):

Upside capture helps drive excess returns

Average Down Market Month (-3.81%):

Prudent risk controls preserve capital better when small caps decline

The strategy aligns volatility with the small cap asset class, rather than taking on substantial additional risk for marginal gains. The higher Sharpe and alpha confirms effective stock selection skill generates returns, not just broad exposure.

Check the Fact Sheet by clicking here

Investing in the Small Cap Investment Strategy by Lyons Wealth

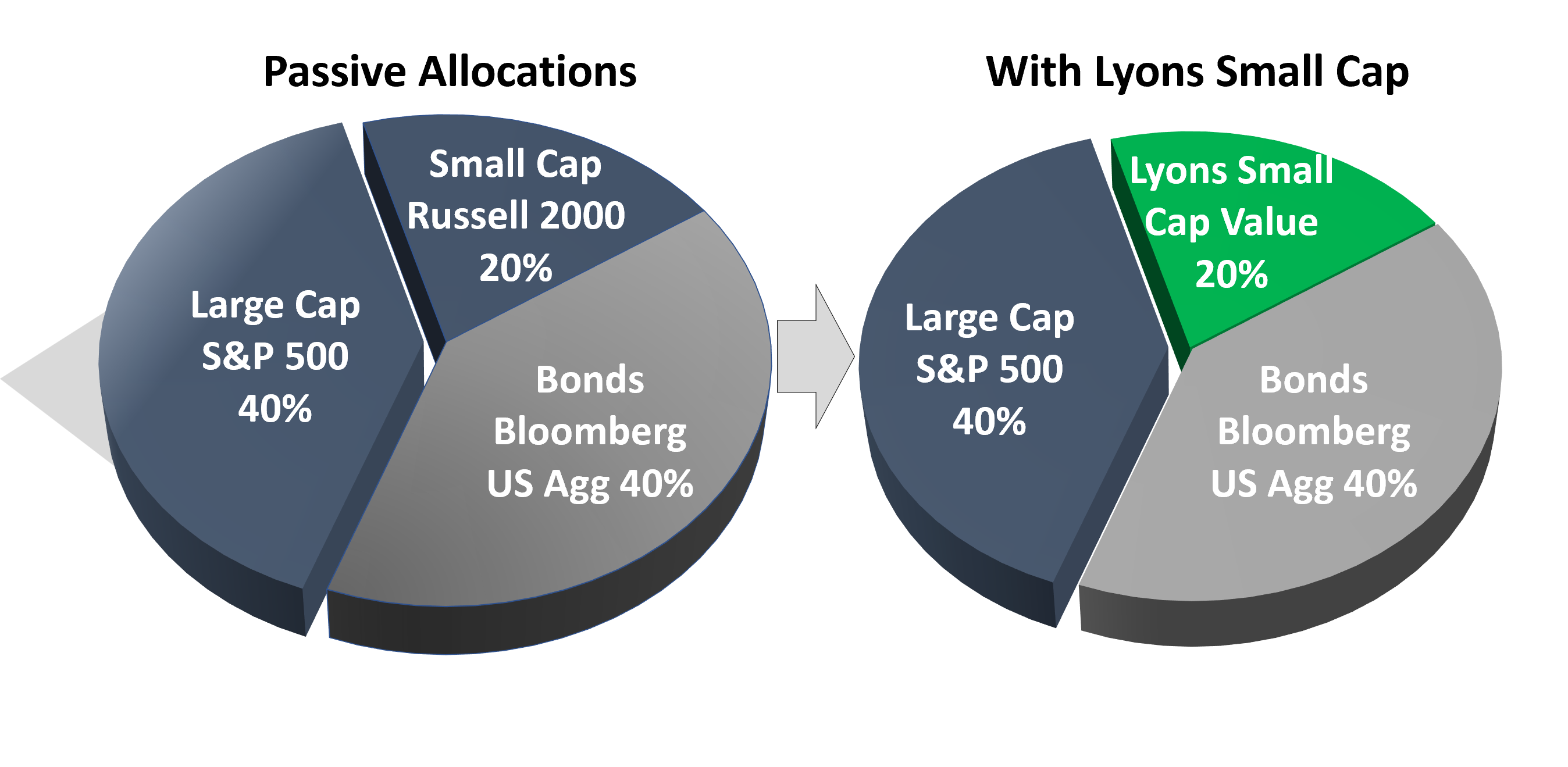

The Lyons Wealth Small Cap Value Strategy offers a compelling avenue to participate in the exponential growth smaller companies can achieve. By investing with Lyons Wealth, clients gain professional guidance navigating this higher-returning yet complex arena.

If you are interested in exploring how our 5-star rated portfolio can potentially boost your investment performance over the long-run, take the next step by clicking here to fill out the form

FAQs

Is it a good idea to invest in small-cap?

Small-cap stocks involve high risk but have the potential for significant growth. If the investor is aware of the risk, they can be a good idea.

Is small-cap value a good investment?

Small Cap Value can be a good investment if a high-quality company is chosen. It takes time and risk to determine which Small Cap companies have the potential to grow.

What is the average return of a small-cap fund in 10 years?

Within a ten-year timeframe, investing in small-cap stocks could get you anywhere between 17-24% return. But please be advised that the returns depend on the company's performance.

How long should I invest in small-cap?

You should investment in Small Cap growth stocks for at least five to six years. It takes time for companies to grow, and you won't realize your investment immediately.