Sander Read to Speak at the Institutional Crypto Conference 2025

16 Best Stocks for Long Term Investment [Handpicked by Lyons Wealth]

How Do You Make Money in the Stock Market - 5 Ways

Best Way to Invest 200K to Grow Your Income in 2025

How to Invest 5 Million Dollars for Income

How to Invest 100k to Make 1 Million Dollars: Your Guide to Financial Growth

How Much Money Do I Need to Invest to Make $3000 a Month? An Investment Blueprint

Which Investment Has The Least Liquidity?

Short-Term Stock Investment 101:

An Essential Guide

5 Essential Tips to Sell Covered Calls

Income Investment Strategies

How To Invest 2 Million Dollars

How To Invest 1 Million Dollars

How To Build Wealth In Your 30s

How To Build Wealth In Your 40s

How To Build Wealth In Your 50s

How To Invest 500k

Wealth Management Firms: How to Know When to Hire One

10 Smart and Safe Investments with 10% ROI this 2025

10 Benefits of Hiring a Wealth Manager

5 Things to Consider When Hiring a Wealth Management Firm

Lyons Launches Lyons CoinDesk Large Cap Select Index SMA

10 Best Stocks for Covered Calls

How Much Money for Wealth Management

Downside Protection Strategies

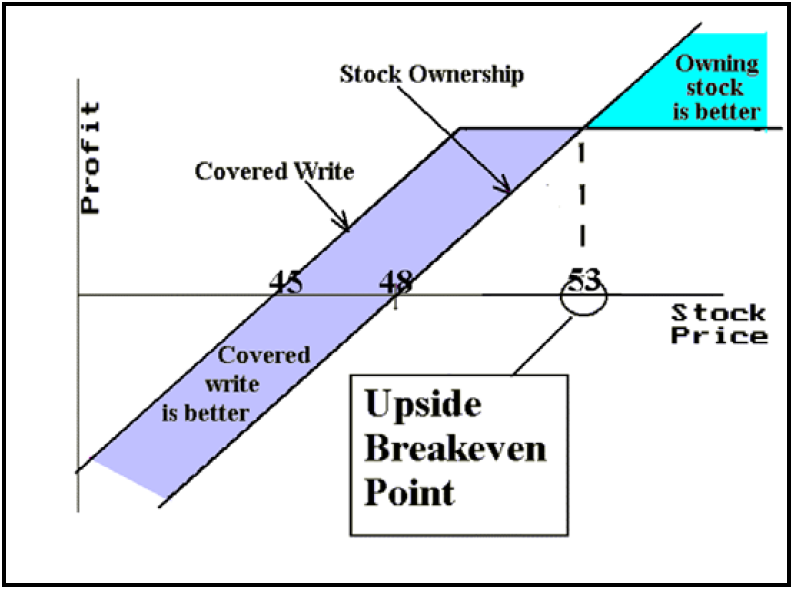

Pros and Cons of Covered Call

What Are The Best Wealth Management Firms

7 Tips for Successful Covered Call Writing

:max_bytes(150000):strip_icc():format(webp)/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

Covered Call Management

Monthly Income from 100k Investment

Options Income Strategies

Do I need a financial advisor for my 401k

Concentrated Stock Position Strategy

Covered Call Strategy

Florida Financial Advisors

Is The Market Reaching New Highs

How Much To Live Off Dividends

7 Best Countries for Wealth Management