10 Smart and Safe Investments with 10% ROI this 2025

While it's nice to save money for a rainy day, you won't get to grow your assets if you place your money in high-yield savings accounts. This is where investments come in. An investment is an item or asset acquired with the goal of generating income. Most people consider a 'good' investment around 7% per year, but what if you can grow your money further?

Believe it or not, there are assets you can add to your investment portfolio that can generate 10% ROI. While there's no guarantee that you'd secure this significant return, many investments have proven to produce these results and are more likely to make the same rate in the future.

Where can I get 10 percent return on investment?

For almost any type of investment, the longer you hold that investment, the more valuable it eventually becomes. In general, long-term investments tend to perform better because they account for possible short-term fluctuations. You wouldn't want to sell an asset when the value is down, but the reality is that many investments have dips, but they usually recover, and their value appreciates after the drop.

Real estate and venturing into the stock market are usually top-of-mind when people think of investments. These are great options, but there are other alternatives that have the potential to perform better.

1. Invest in stock for the long haul.

The general rule is that long-term investments tend to be less volatile than short-term ones. Even stocks that have volatile movement can help you produce stable returns in the long run. In addition, you get to earn a tax advantage for holding stocks for at least a full year.

This strategy involves holding assets like investment-grade bonds, stocks, exchange-traded funds or ETFs, mutual funds, and the like. If you choose this type of investment, you need to be patient and disciplined. There's no guaranteed income when you're investing in stocks. Moreover, you should be willing to take on a certain amount of risk while waiting for the high rewards down the road.

What's excellent about stocks is that they offer investors the best potential for growth (capital appreciation) in the long run. Investors that have chosen to stick with stocks over a long period, like 15 years, generally have been rewarded with a robust and positive return on investment.

On the other hand, stock prices move up and down. There's no guarantee that the stock you choose will grow and do well, so there's a potential for you to lose money through this investment. The risks of investing in stocks are often offset by investing in several different stocks.

2. Invest in stocks for the short term.

While you have a better chance of enjoying profit with long-term stock investments, some people make a significant amount of income through short-term investments in stocks. This is where day trading comes in.

Day trading involves actively buying and selling securities within the same day. This type of investment aims to capitalize on short-term price changes. People often get involved in this endeavor by borrowing or leveraging capital daily to buy additional assets. However, this also substantially increases your risk.

When a stock suddenly gains momentum rapidly, its price can rise in a short amount of time. A short-term surge in price can last as quickly as a few minutes and drag on to a few days. To succeed in this strategy as a trader, you need to understand the risks and rewards of every trade. You should know how to identify good short-term investment opportunities while learning how to protect yourself.

Through this investment strategy, you need to learn how to recognize potential candidates to earn at least 10% in returns. Many investors get caught up in the moment and lose money. To make money from short-term stock investments, you should watch the moving averages or the stock's average price within a particular period. You also need to understand the overall cycles or patterns well. It would also be best if you had a good sense of the market trends.

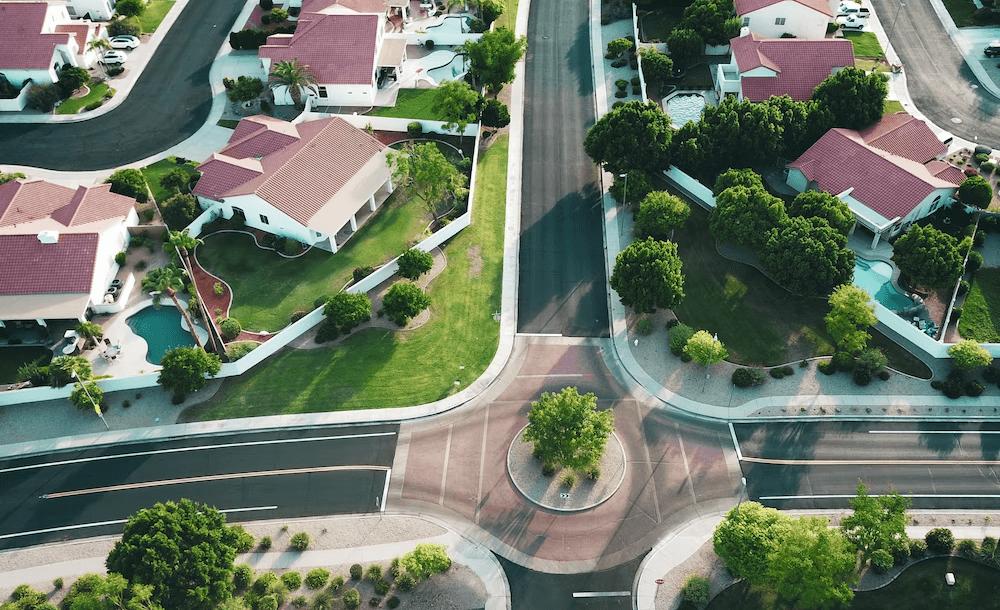

3. Real estate

Real estate is one of the most popular investment options for people who intend to grow their assets. While ideally, you should purchase your own real estate, you don't necessarily need to be a house or commercial real estate to be involved in this investment strategy.

Real estate acts as an inflation hedge and can provide multiple opportunities for creating income. If you have the purchasing power to buy a property, you can have it rented out and enjoy the monthly payment. Rent also tends to increase in the long run, which can lead to a higher cash flow.

Even if you don't have the property rented out, your investment is in good hands because real estate tends to increase in value over time. You can enjoy great profit if you decide to sell that place in the future. You can expect its net asset value to boom if you also invest in a promising area. Real estate property managers can help you choose the best options within your budget for this endeavor to be within your reach.

If you don't have the means to purchase a second home, you could rent out a single room in your property long-term or short-term through platforms like Airbnb. You'll enjoy good returns if you find a well-behaved tenant who pays on time.

4. Investing in fine art

The main benefits of investing in fine art are the sense of satisfaction of personal satisfaction and the monetary benefit of an artwork's appreciation in value over time. Unlike money market funds, people who invest in fine art get to enjoy the fact they get to see and appreciate their investments daily.

As a financial investment, fine art often appreciates in value independent of traditional economic measures like inflation or securities market indexes. While it takes a while for artwork to increase in value, this type of investment doesn't lose value like its traditional counterparts in the equities market. Moreover, there's no art equivalent to a company going out of business.

Another significant difference between investing in art and traditional investment accounts is the duration of the investment. A bond or stock held for at least a year is considered a long-term investment. Meanwhile, you would need to hold on to a piece of fine art for decades.

Like any type of investment, it requires some expertise to be successful in art investment. It's easy to purchase a sculpture or photograph that one likes, but it's not the same as buying a piece that has the potential to increase in value over time. However, if you choose to invest money in a good piece, the market value will surely be worth the price.

5. Starting your own business.

While you can invest in companies through the stock market, there's nothing quite investing in yourself. If you have the knack for business and some capital to get started, you should create your own business. This type of investment has unlimited potential for growth and high returns.

The biggest hurdle to starting a business is capital. You don't just account for the money needed to set up the business. You must also consider the government fees, monthly operational expenses, equipment, and other assets required to launch that endeavor.

Moreover, there's also a chance that your business would slow down, not earn, or worse, go bankrupt due to unforeseen circumstances. Although you own the company, your cash flow isn't fluid, and you may not be able to pull out money in case of an emergency. Despite the possibilities, there are infinite opportunities for growth if everything works out for you. You may even become encouraged to venture into various businesses for a diversified portfolio.

You don't necessarily have to set up a huge business. For example, if you're a graphic designer, you can start a company wherein you do some work and outsource the rest to others. You would then receive a percentage of the profits because you connected the designer and the client.

If you're not interested in starting a business yourself, another excellent option you can explore is investing in another person's business idea. Many crowdfunding platforms allow you to invest your money into profitable companies that have the potential to thrive and succeed. On the other hand, you expose yourself to the same risks of owning a business when you invest in a startup.

6. Investing in wine.

While there's nothing wrong with money market accounts, it would pay for you to diversify your portfolio and invest in an asset class that's proven to increase in value in the long run. Another excellent investment you should consider is fine wine.

Fine wine has less long-term volatility as opposed to most other investments, including gold and real estate. Historical performance has proven that this particular asset has appreciated at a stable rate. There's a good reason people like saying 'aging like fine wine,' after all.

Fine wine has several characteristics that make it an excellent investment. For example, it's a tangible asset unaffected by the same factors as stocks and other financial assets. Moreover, the global fine wine market is growing at a stable rate, meaning there is a potential for an increase in prices over time.

On the other hand, you must conduct thorough research to ensure that the interest income you will enjoy from this investment will be worth it in the long run. Additionally, you should store your collection in the right environment to maintain its quality. Investing in fine wine may be lucrative in the long haul, but it's not the best option for investors looking to cash in from their endeavors soon.

7. Peer-to-peer lending

Suppose you have a considerable amount of money in your savings account. In that case, you have a better chance of growing that money by lending a portion to people or businesses in immediate need of cash. Much like a bank, you, as an investor, would give someone a loan and charge a special interest rate.

Sometimes, people are unable to secure loans from banks and other financial institutions. In other cases, people would rather borrow money from other people as opposed to a bank. This is where peer-to-peer lending comes in.

Peer-to-peer lending is an excellent investment opportunity because you profit from this endeavor in two ways. First, you get to be repaid the amount you lend to that person or business. This is usually a high-interest debt, and thus, you get to enjoy a considerable return through interest.

As with any investment, there's an inherent risk involved when you get into peer-to-peer lending. You're not subject to treasury inflation-protected securities when you're involved with this endeavor. Moreover, there's a chance that the person or business you lend money to might run away or not pay you on time. To reduce this risk, you should consider some like a secured peer-to-peer lending investment platform. You'll have some protection from potential flight risks through their system.

8. Invest in REITs

Another excellent way to grow your money is through a real estate investment trust. Real estate investment trusts (REITs) are businesses that own cash-flow-producing real estate and pool various investors' money to obtain and manage real estate investments.

These properties are usually high-end or commercial real estate. Unlike other types of real estate investments, REITs are liquid assets that you can sell at any time. These companies give dividend stocks to investors. You can purchase REITs through major brokerage firms if this piques your interest.

9. Invest in gold, silver, and other precious metals

While mining may not be popular today, many investors still get into investing in gold, silver, and other precious metals. Precious metals offer unique inflationary protection. They have intrinsic value, no credit risk, and cannot be inflated. Moreover, they offer investors upheaval insurance against financial or political upheavals.

To put things into perspective, gold has no counterpart liability, and as an asset, it can be held by an investor that is free from debt. It's transparently priced on global exchanges and highly liquid. In addition, precious metals can be exchanged quickly and easily sold in case that person needs cash immediately.

10. Junk bonds

Bonds are categorized as investment-grade bonds or junk bonds. Junk bonds are high-yield, high-risk bonds. These bonds come from companies that have low credit scores. The general rule in this type of investment is that the higher the risks of the bond you choose, the greater return you enjoy to justify your investment.

While the return on investment on this type of bond may be attractive, you have to account for the high risk involved. On the other hand, this bond can boost overall returns in your portfolio. This allows you to avoid the high volatility of stocks. Either way, it's a more lucrative endeavor as opposed to leaving your money in a savings account.