Tactical Asset Allocation Strategy by Lyons Wealth

Most people assume that income from investing in the stock market relies heavily on market trends. While this may be true to a certain extent, there are investment strategies that empower people to protect their assets in the long run. One way to optimize one's assets, regardless of market performance, is a tactical asset allocation strategy.

| Inception Date: | April 30, 2012 |

|---|---|

| Lipper Category | U.S. Tactical Allocation |

| Account Type | Separately Managed Account |

| Minimum Investment | $100,000 USD |

| Benchmark | Lipper Flexible Portfolio Funds Index |

Q3 2025 FACT SHEET TALK TO AN EXPERT

What Is Tactical Asset Allocation?

Tactical Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The primary goal of tactical asset allocation is to move portfolio returns and achieve an optimal balance between risk and return based on an investor's financial objectives, risk tolerance, and time horizon.

Understanding the Basics of Tactical Asset Allocation Strategy

Tactical Asset Allocation Example

Let's say John Smith indicated in his investment policy statement that he'd like to divide his asset allocation into 45% stocks, 45% bonds, and 10% cash. Among these asset classes, stocks usually perform the best.

John was informed by a financial advisor that the yield curve had inverted, indicating a possible recession. That financial advisor then advised John to shift his asset class to 20% stocks, 70% bonds, and 10% cash because of fear of recession and possible poor stock returns. By providing this suggestion, that financial advisor is using tactical asset allocation.

Lyons Tactical Allocation Portfolio Investment Strategy: A Breakdown

The Lyons Tactical Allocation Portfolio employs an active yet disciplined investment process to balance offense and defense over market cycles. Here is an overview of the key components:

Offensive Equity Portfolio

- Investment Universe: Quantitative screening and ranking to focus the universe

- Research Process: Fundamental analysis evaluates opportunities

- Portfolio Construction: Concentrated portfolio of 20-30 stocks

- Rebalancing: Quarterly rebalances when portfolio remains fully invested

The equity portfolio emphasizes stock selection to drive returns during sustained upside trends. Concentration allows the best ideas to have meaningful impact.

Defensive Tactical Asset Allocation

- Monthly Signals: Proprietary model determines equity or bond allocation

- Equity Offense: Market tailwinds signal a fully invested stock allocation

- Bond Defense: Market headwinds trigger shift to preserve capital

This tactical shift between equities and bonds allows the portfolio to adapt to changing market conditions.

Protective Option Hedging

- Headline Hedging: Options buffer unexpected short-term drawdowns

- Whipsaw Hedging: Options smooth transitions between offense and defense

Targeted option hedging aims to reduce volatility risk during both bull and bear markets.

By integrating offense, defense, and risk management, the tactical allocation approach balances growth and preservation.

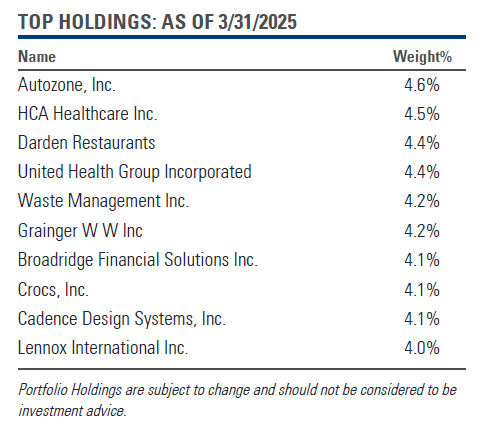

Here are the top holdings as of 3/31/2025:

Why Choose Lyons Tactical Allocation Portfolio Investment Strategy?

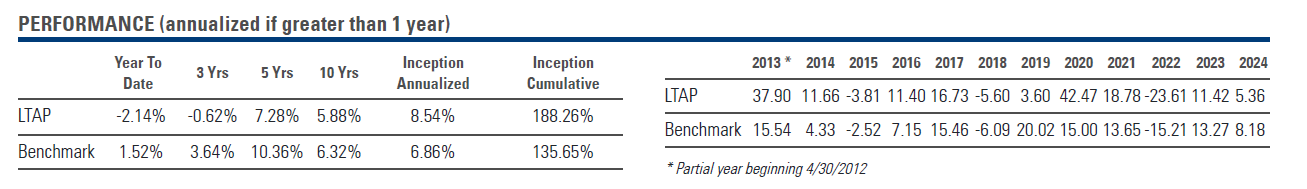

The Lyons Tactical Allocation Portfolio has consistently outperformed its benchmark and peer funds over time. Here is why it stands out as an attractive choice:

Superior Risk-Adjusted Returns

The portfolio has achieved an annualized return of over 9% since inception, compared to 7% for its benchmark. This outperformance translates to over 50% greater cumulative gains. Meanwhile, tactical shifts help preserve capital during downturns.

Upside Growth with Downside Protection

The portfolio captures over 100% of benchmark returns during bull markets. During bear markets, it preserves capital far better, with 86.9% downside capture. This balance allows investors to maintain exposure for long-term compounding.

Consistent and Repeatable Process

With a 10-year 5-star Morningstar rating, the portfolio has delivered through a full market cycle. Its rules-based process balances offense and defense to navigate any environment.

You can check our Fact Sheet by clicking here

By integrating quantitative signals with fundamental analysis, the Lyons Tactical Allocation Portfolio supplies a category-leading solution for growth with built-in risk management. Investors can compound returns while avoiding the pitfalls of needing to time short-term swings.

In addition, our firm offers exceptional service and support tailored to client needs:

Tailored strategies. At Lyons Wealth, we offer clients a tailored strategy that addresses their priorities. Our mission is to deliver unparalleled client experience while developing a business our team will want to work at indefinitely.

Award-winning reputation. Lyons Wealth Management is an award-winning wealth and investment management firm with a reputation for successfully helping affluent clients reach their personal financial goals and securing their financial futures.

A talented team of professionals. Our team at Lyons Wealth Management comprises gifted professionals with backgrounds in finance, portfolio management, entrepreneurship, and technology. We are in the business of helping our clients not only reach but exceed their financial goals and dreams.

Key Objectives of Lyons Tactical Allocation Portfolio Investment Strategy

- Greater upside capture through sustained bull market participation and full equity allocations for long-term, continuous time periods

- Less whipsaw by making fewer defensive shifts

- Capital preservation in bear markets

- Risk hedging against short-term weakness and whipsaw

- Alpha potential from active stock selection

What are the pros and cons of tactical asset allocation?

Tactical asset allocation strategies can help you weather the volatile stock market. Here are some advantages of this asset allocation:

- Responsiveness to market trends. The flexibility of tactical asset allocation empowers investors to adapt their portfolios to volatile market conditions, which can be particularly beneficial during increased market instability.

- Enhanced risk management. This asset allocation strategy allows investors to maintain their desired risk profile and protect them against downside risks during periods of market stress.

- Possibility of higher returns. This strategy can potentially bring excess returns by capitalizing on short-term market inefficiencies and adjusting the portfolio to exploit emerging opportunities.

Get Started with the Lyons Tactical Asset Allocation Strategy

The Lyons Tactical Allocation Portfolio offers investors an attractive opportunity to capture market growth while protecting capital. Its balance of offense and defense has navigated all market environments with exceptional returns.

If you are interested in learning more and assessing if this portfolio could benefit your financial plan, take the next step by clicking here clicking here

FAQs

Is tactical asset allocation risky?

As with any investment, tactical asset allocation comes with certain risks. There is the potential for increased costs, underperformance, and a focus on short-term market trends.

Is tactical allocation a winning strategy?

This strategy can be a winning strategy in the long term. If your priority is protecting the value of your assets, this might work well for you.

What is better, tactical or strategic?

Both approaches have their own advantages and disadvantages. The better option would depend on someone's priorities and risk profile.